| Name of Document | FY 2024-25 Proposed |

| Official Transcript | 2,000 |

| Medium of Instruction | 1,200 |

| HEC Equivalence | 1,200 |

| To Whom It May Concern | 1,200 |

| Character Certificate | 1,200 |

| NOC | 1,200 |

| Provisional Equivalence / Hope Certificate | None |

| Duplicate Degree | 16,000 |

| Degree Attestation / Verification outside Pakistan | 6,000 |

| Degree Attestation / Verification inside Pakistan | 3,500 |

| Late Degree Commencement (After Commencement) | 5,000 |

| Bonafide Certificate | None |

| Overseas Mailing | |

| Urgent Degree | 15,000 |

| Verification of Record of Old/Lost Degree/Result Card issuance from Punjab University of our previous students: | |

| Regular Charges | 3,500 |

| Urgent Charges | 5,000 |

Instructions for Fee Payments through Online Fee Payment Channels

HBL Internet Banking

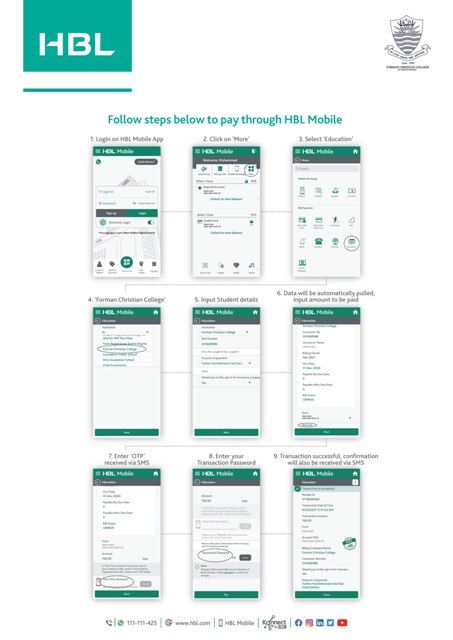

HBL Mobile App

Konnect by HBL Customer App

Meezan Bank Online Internet Banking/Mobile Applications

Click here for the instructions For Meezan Bank Online Internet Banking

Click here for the instructions For Meezan Bank Mobile Application

UBL Internet Banking

UBL Mobile App

Please click here to view the step by step process

MCB Live

Quick Bill Pay

Please click here to access the online challan form

*Note: Please enter the correct information in the challan form fields to ensure payment in your accounts.

Please click here to access Financial Appeal Committee Form

Please click here to download Application Form

Refund Form (For Baccalaureate & Postgraduate – New Admissions only) Please click here to download

BILLING AND FEES ISSUES

How to enter roll number on the fee challan?

For fee challan purposes, you must enter roll number of Nine (9) Characters.

If your original roll number is less than the Nine Characters, please add Zero(s) before your original roll number to complete the Nine Characters roll number.

For Example, you have original roll number 18-22001. This roll number has Eight (8) characters. So you need to add one zero before your roll number as 018-22001 which will be entered on the fee challan at the time of payment.

For Example, you have original roll number 18-2001. This roll number has Seven (7) characters. So you need to add two zeros before your roll number as 0018-2001 which will be entered on the fee challan at the time of payment.

For Example, you have original roll number 431240. This roll number has Six (6) characters. So you need to add three zeros before your roll number as 000431240 which will be entered on the fee challan at the time of payment.

What is the tax that is showing up on my billing statement?

(Please click here to calculate your tax)

According to the Income Tax Ordinance, all educational institutions are required to charge and collect advance income tax from their students and deposit this into government treasury where fee in a fiscal year (July to June) exceeds Rs. 200,000. Because FCCU is an educational institution, therefore, collection of this tax on fee is the requirement of Income Tax Ordinance 2001. The exact section of this Income Tax Ordinance is reproduced below

Why Tax on Fee is Charged?

236I. Collection of advance tax by educational institutions

(1)There shall be collected advance tax at the rate specified in Division XVI of Part-IV of the First Schedule on the amount of fee paid to an educational institution.

(2)The person preparing fee voucher or challan shall charge advance tax under sub-section (1) in the manner the fee is charged.

(3) Advance tax under this section shall not be collected from a person on an amount which is paid by way of scholarship or where annual fee does not exceed two hundred thousand rupees.

(4) The term “fee” includes, tuition fee and all charges received by the educational institution, by whatever name called, excluding the amount which is refundable.

(5) Tax collected under this section shall be adjustable against the tax liability of either of the parents or guardian making payment of the fee.

(6) Advance tax under this section shall not be collected from a person who is a non-resident and

(i) furnishes copy of passport as an evidence to the educational institution that during previous tax year, his stay in Pakistan was less than one hundred eighty-three days;

(ii) furnishes a certificate that he has no Pakistan-source income; and

(iii) the fee is remitted directly from abroad through normal banking channels to the bank account of the educational institution.

Division XVI

Collection of advance tax by educational institutions

The rate of collection of tax under section 236I shall be 5% of the amount of fee.

Click here for Advance Tax on Fee – Tax Laws Provisions & Related Illustrations.

Click here for SOP for Advance Tax on Tuition Fee

Tax Calculation:

Refer the below illustrative examples to understand how the tax is calculated as per the requirements of the tax laws. This calculation is to be done in a fiscal year (July to June).

| Tax Calculation | Students on Financial Aid | Students not on Financial Aid |

| Tuition Fee– Fall | 125,000 | 125,000 |

| Tuition Fee– Spring | 125,000 | 125,000 |

| Lab Fee | 3,000 | 3,000 |

| Hostel & Mess Fee | 50,000 | 50,000 |

| Others | 5,000 | 5,000 |

| Admissions Fee | 17,000 | 17,000 |

| Security (Refundable) | 15,000 | 15,000 |

| Total Fee (Including Security) | 340,000 | 340,000 |

| Less: Security Fee (Refundable) | (15,000) | (15,000) |

| Less: Financial Aid | (100,000) | – |

| Taxable Fee | 225,000 | 325,000 |

| Tax Rate | 5% | 5% |

| Tax Amount | 11,250 | 16,250 |

| If Fall Semester Fee is greater Than 200,000 | |||

| Tax calculation | Note | Fall | Spring |

| Tuition Fee – Fall | 221,000 | – | |

| Tuition Fee – Spring | – | 221,000 | |

| Lab Fee | 3,000 | 3,000 | |

| Hostel & Mess Fee | 25,000 | 25,000 | |

| Others | 5,000 | 5,000 | |

| Admissions Fee | 17,000 | – | |

| Security (Refundable) | 15,000 | – | |

| Total amount paid | A | 286,000 | 254,000 |

| Less: Security Fee (Refundable) | B | (15,000) | – |

| Less: Financial Aid | C | (50,000) | (50,000) |

| Add: Taxable Fee from previous semester | D | – | 221,000 |

| Taxable fee | E=A-B-C+D | 221,000 | 425,000 |

| Tax Rate | 5% | 5% | |

| Tax calculated | F | 11,050 | 21,250 |

| Tax already paid in previous semester | G | – | 11,050 |

| Tax payable in the semester | I=F-G | 11,050 | 10,200 |

| If Fall Semester Fee is Less Than 200,000 but cumulative annual fee is greater than 200,000 | |||

| Tax calculation | Note | Fall | Spring |

| Tuition Fee – Fall | 125,000 | – | |

| Tuition Fee – Spring | – | 125,000 | |

| Lab Fee | 3,000 | 3,000 | |

| Hostel & Mess Fee | 25,000 | 25,000 | |

| Others | 5,000 | 5,000 | |

| Admissions Fee | 17,000 | – | |

| Security (Refundable) | 15,000 | – | |

| Total amount paid | A | 190,000 | 158,000 |

| Less: Security Fee (Refundable) | B | (15,000) | – |

| Less: Financial Aid | C | (50,000) | (50,000) |

| Add: Taxable Fee from previous semester | D | – | 125,000 |

| Taxable fee | E=A-B-C+D | 125,000 | 233,000 |

| Tax Rate | 5% | 5% | |

| Tax calculated | F | – | 11,650 |

| Tax already paid in previous semester | G | – | – |

| Tax payable in the semester | I=F-G | – | 11,650 |

Important:

If any student taking summer/winter semester as well then fee of that semester will also be added in the above calculations. Students are advised to check the amount charged in the empower accounts as per the above requirements and illustrative example. In case a student finds any discrepancy in the tax amount charged in the account, please address this to fccaccounts@fccollege.edu.pk.com for resolution of any issue.

Why do we pay extra for science lab courses when we already pay for the fourth credit?

The cost we charge per credit is charged to cover the cost of the having the course. This includes the salary of the instructor as well as the cost of running the electricity, air conditioning/heat, furniture and maintenance and other costs outside of the classroom that support the students in the university. Things such as water, plumbing, staff to take care of the grounds and buildings, and administrative staff to run the university.

When you take any 4 credit course, the extra time in the course actually costs extra to run. It involves more electricity, more faculty time, etc. so, you pay for the credit.

The lab fees are charged because a lab course involves additional expenses. Chemicals, equipment, lab attendants, and additional electricity are examples of that. Many universities charge extra for a BS(Hons) degree. We felt like it was fairer to charge per course because not all BS (Hons) degrees incur extra expenses and not all courses, even in the Natural and Physical Sciences involve labs.

Why does the amount I owe change?

The amount shown on your account is what you owed at the most recent “bill run.” This is done at the end of the day every day during registration and entry times and every week or so during the other times. This means that, if there has been a change in your account during the time between runs (you have added a class for example), the amount you owe will change when the bill is run. It does not change instantly. If you know that you have a charge to your account, you can pay it even before it shows up on your statement.

If you are a full time student, you should plan to pay your fees according to the amount given on the website. You do not need to wait to see what your billing statement says.

You should check on your account weekly just to be sure everything is alright with it. Proctorial fines or tax are not always posted right after they happen.

Why are our fees increased? How do you decide how much the increase will be?

There are a number of things considered when fees are increased. The most obvious is the inflation rate (cost of living). Other considerations are salary increases for faculty and staff, increased operating expenses (for example, adding the extension on E Block increases the cost of electricity and water on a daily basis), and available scholarship budget for meeting student needs. In addition, we have to budget for the long term sustainability of the university. The goal is to not have to rely on outside sources for funding except in the case of building or other special projects.

We look at our strategic plan and decide what needs to be done to improve or maintain the quality of education being offered and at the tuition costs of market competitors (we try to stay below them), then we make a proposal to the Finance Committee and finally to the Board of Governors.

We try to balance the needs of the university with the desire to keep the cost of an education here reasonable.

How are our fees used?

Staff and faculty salaries, scholarships, operating expenses such as utilities, repairs, office supplies, furniture and equipment and events. It also covers student related expenses such as the Mercy Health Center, the College Counseling Center and other student life and student services departments.

What is the financial appeals committee? What can I appeal? How do I make an appeal?

A Committee has been constituted to handle different cases to facilitate students when there are exceptional circumstances. This includes payment concerns, withdrawal due to medical or other emergency issues, billing issues or any other concerns a student has that is a request for an exception to policy. A weekly meeting is held to review applications under expertise of various departments and results are then communicated to the students. Please note that filing an appeal does not guarantee the request will be granted. The committee looks at the circumstances and then makes a decision based on its ability to apply the same outcome fairly in all similar cases.

To apply, an online application form can be accessed at https://forms.gle/Wggr5WgE2zPm3y7F6

All points mentioned below are important. Please read carefully.

PAYMENT ISSUES

Is there another way to pay besides the HBL branch on campus? If I pay at another branch, how do I get credit for my fees?

The best option is to pay fee through internet banking/mobile applications of HBL and Meezan Bank. You can also pay your fees at any HBL, MCB, Meezan Bank and UBL branch in Pakistan.

I have paid fees that is not showing in my account?

If your paid fee is not updated within two working days of payment of fee, you will need to either bring your paid challan to the accounts office or email a picture or scanned copy of it to fccfeechallans@fccollege.edu.pk. This is because banks send a list of payments made to us but there is nothing on the list telling us who made the payments. Your fee challan has your roll number on it. That allows us to make sure that your payment is credited to your account.

How can I find out how much I owe without going to the accounts office window?

All of the information you need is on your EMPOWER account.

How do I sign up for an installment plan?

You do not need to sign up for the installment plan anymore. The due dates are strictly followed, however, so you need to keep up with them. You can get information on the FCCU website. www.fccollege.edu.pk/tuition-fee/

What do I do if I have a hold on my account?

The first step is to find out why you have a hold. There are several types. If it is a Business hold, that can be checked at either of the student dealing windows. One is in the accounts office and the other is directly across the hall. If the hold is for a different reason, you will need to see that office to have it removed.

FINANCIAL AID ISSUES

What kinds of financial aid are available?

Financial aid refers to any financial assistance given to a student. This includes need based aid, merit scholarships upon admission, TA ships, Work study opportunities, and scholarships provided by outside agencies. We do not determine eligibility for the outside scholarships but we assist in the application process.

How do I apply for financial aid?

Students may apply for financial aid when applications are open. These dates are advertised around campus and on the website. The fee for an application is Rs. 500. Pay this amount in the FC campus bank branch and then bring the challan to the window in the Ahmed Saeed Building Room #15. You will have to have your FC email account activated. The link for your form will be sent to your FC email account only. Fill out the information online and submit it for the issuance of your confirmation code. You MUST ALSO submit a hard copy of your form with all of the supporting documentation.

Be sure to include all sources of income. If you are found to have left out a source, you will not receive aid and a prescribed fine amount may be imposed for misrepresentation of information.

How much financial aid is awarded?

In the year 2016-2017, 1,462 students have received aid of some sort. Rs. 138 million has been awarded.

How do I contact the Financial Aid office?

The financial aid office is located in rooms 15 -17 in the Ahmed Saeed Administration Building. The window in room 15 should be your first point of contact.

The email address is financialaid@fccollege.edu.pk